Disclosure: This post contains affiliate links and I will be compensated if you make a purchase after clicking through my links. Learn More

Switching to clean energy is a smart move for homeowners. It saves money and helps the planet.

The Residential Clean Energy Credit makes this shift even more appealing. It’s a government incentive designed to encourage the use of renewable energy in homes. This credit can significantly reduce the cost of installing solar panels, wind turbines, and other eco-friendly energy systems.

Homeowners can get a sizable tax break, making clean energy more affordable. By taking advantage of this credit, you not only cut down on energy bills but also contribute to a greener future. This blog will guide you through the benefits and how you can qualify for this helpful credit. Let’s dive in and see how you can benefit from the Residential Clean Energy Credit.

Credit: www.youtube.com

Introduction To Clean Energy Credits

Clean energy is no longer just a buzzword; it’s a practical choice for many homeowners. The Residential Clean Energy Credit is designed to encourage this positive shift. But what exactly is it, and how can it benefit you?

Benefits For Homeowners

Imagine reducing your monthly utility bills while also increasing the value of your home. With the Residential Clean Energy Credit, you can do just that. This credit offers financial incentives for installing solar panels, wind turbines, and other clean energy systems.

Many homeowners have already started reaping the benefits. A friend of mine installed solar panels last year and saw a 30% reduction in his electricity bill. Are you ready to join the growing number of people taking control of their energy costs?

Environmental Impact

Every step towards clean energy counts. By choosing renewable sources, you’re reducing your carbon footprint and contributing to a healthier planet. This isn’t just about saving money; it’s about making a real difference.

Consider how much energy you use daily. Now, think about how much of that could come from clean sources. The shift might seem small, but collectively, it has a massive impact.

Are you ready to be part of the solution? Embracing the Residential Clean Energy Credit is a step forward in protecting our environment for future generations.

Types Of Residential Clean Energy Systems

Exploring residential clean energy systems offers exciting possibilities for homeowners. These systems reduce electricity bills and minimize environmental impact. They also contribute to a sustainable future. Understanding the types of these systems is vital. It helps in making informed decisions.

Solar Power Systems

Solar power systems harness sunlight to generate electricity. They consist of solar panels installed on rooftops or in open areas. These panels convert sunlight into usable energy. Solar systems are popular for their efficiency and cost-effectiveness. They work best in sunny locations. Even on cloudy days, they produce some energy. This makes them reliable. Many homeowners prefer solar systems for their long-term benefits.

Wind Energy Solutions

Wind energy solutions utilize wind turbines to create power. These turbines are installed in areas with strong winds. They convert kinetic energy from wind into electrical energy. Wind systems are ideal in rural or coastal regions. They require space for turbine installation. Wind energy is sustainable and clean. It helps reduce reliance on fossil fuels. Homeowners can benefit from wind energy with proper planning.

Eligibility For Energy Credits

The Residential Clean Energy Credit offers many homeowners a way to save. Understanding if you qualify is crucial. This section will guide you through the eligibility requirements. Discover how your home and energy installations can make you eligible.

Home Requirements

First, your home must be in the United States. It must be your primary residence. Rental properties do not qualify for this credit. You also need to own the home. Renters cannot claim this credit.

Qualifying Energy Installations

Next, the energy installations must meet specific criteria. Solar panels are a popular choice. They convert sunlight to electricity. Solar water heaters also qualify. They use sunlight to heat water for your home.

Wind turbines can generate electricity for your home. They use wind power to create energy. Geothermal heat pumps are another option. They use the earth’s heat to warm and cool your home. Fuel cells are advanced systems that also qualify. They generate electricity through a chemical process.

Ensure these systems meet the efficiency standards. They must be new and installed by professionals. DIY installations do not qualify for the credit.

Credit: tax.thomsonreuters.com

Calculating Potential Savings

Calculating potential savings with the Residential Clean Energy Credit helps homeowners see how much they can save on energy costs. This credit supports investments in solar panels and wind turbines. It encourages sustainable living while reducing monthly utility bills.

Calculating the potential savings from the Residential Clean Energy Credit can be a game-changer for homeowners. This tax credit is designed to make clean energy solutions more accessible and affordable. By understanding how much you can save, you can make informed decisions about investing in clean energy for your home.Energy Cost Reductions

Switching to renewable energy sources can significantly cut down your energy bills. Imagine slashing your monthly electricity expenses by installing solar panels or a wind turbine. If your average electricity bill is $100, you might see it drop to $30 or even lower. That’s a potential saving of $840 a year! How would you use that extra cash? Consider using energy-efficient appliances and LED lighting, which further maximizes your savings. The initial cost might seem steep, but the reduction in energy bills can quickly offset this.Long-term Financial Benefits

Investing in clean energy not only saves money now but also benefits you in the long run. Homeowners often see an increase in property value after installing renewable energy systems. Think about how appealing an energy-efficient home is to potential buyers. It could add thousands to your home’s value, making it a smart financial move. Moreover, while fossil fuel prices fluctuate, solar energy remains free. Locking in today’s energy prices protects you from future increases. So, as you consider clean energy options, ask yourself: How much could you save today, and what long-term benefits could you reap?Claiming Your Energy Credit

Claiming your Residential Clean Energy Credit can be a rewarding experience. This credit encourages homeowners to adopt clean energy solutions. It reduces the financial burden of installing solar panels or wind turbines. Understanding the process can help maximize your benefits.

Application Process

Start by completing IRS Form 5695 for your energy credit claim. This form is essential for reporting your home energy improvements. Ensure all details are accurate to avoid delays. Include information about the type of energy systems installed. Double-check the eligibility criteria for each energy source.

Submit the completed form with your annual tax return. This is crucial for processing your credit efficiently. Filing electronically can speed up the process. It reduces the chances of errors and lost paperwork. Consider consulting a tax professional for guidance.

Necessary Documentation

Gather all receipts and invoices for your energy system purchases. Documentation is key for proving your expenses. Include installation costs and equipment details. Keep copies of contracts with installers and suppliers. These documents support your credit claim.

Organize warranty details and manufacturer certifications. These confirm the efficiency of your systems. Make sure to store these documents safely for future reference. Proper documentation ensures a smooth credit claiming process.

.png)

Credit: www.whitehouse.senate.gov

Government Incentives And Programs

Switching to clean energy offers numerous benefits. One major advantage is saving money through government incentives. These programs encourage homeowners to adopt cleaner energy solutions. They reduce upfront costs and make clean energy more affordable. Understanding these incentives can help you make informed decisions.

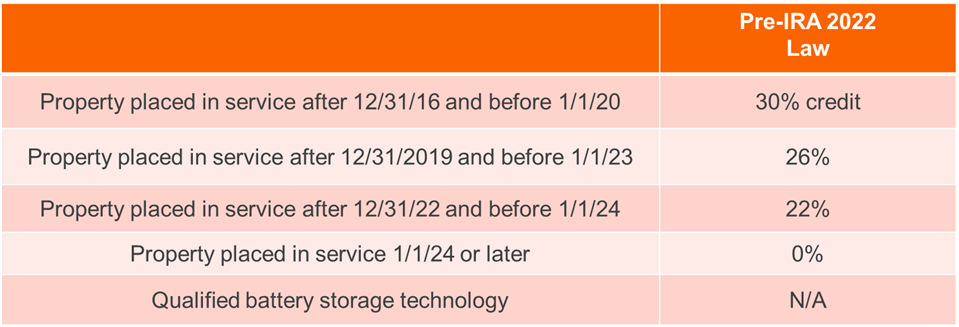

Federal Tax Benefits

The federal government provides tax benefits for clean energy. Homeowners can claim credits on their taxes. This reduces the overall cost of installation. The Residential Clean Energy Credit is one such program. It covers a percentage of installation costs. This credit applies to solar panels, wind turbines, and geothermal systems. By utilizing these credits, you can cut costs significantly.

State-specific Programs

Many states offer their own clean energy programs. These vary widely across the country. Some states provide rebates on equipment. Others offer tax deductions or property tax exemptions. These programs aim to boost clean energy adoption locally. Checking your state’s offerings can lead to additional savings. Some states even have special grants for clean energy projects. These initiatives make clean energy more accessible for homeowners.

Common Challenges And Solutions

Applying for residential clean energy credit often feels confusing. Detailed instructions and expert advice can simplify the process significantly. Many people face issues with documentation but using organized records helps.

Residential clean energy is becoming increasingly popular as more homeowners seek sustainable ways to power their homes. However, transitioning to clean energy isn’t without its challenges. Let’s explore some common challenges you might face and practical solutions to overcome them.Installation Issues

Installation can often be a daunting task for homeowners. One major challenge is finding a reputable contractor. To address this, ask for recommendations from neighbors or friends who have installed clean energy systems. Another issue could be the initial cost, which might seem overwhelming. Consider looking into financing options or government incentives that can ease the financial burden. Did you know that a federal tax credit could significantly reduce your expenses?Maintenance Tips

Keeping your clean energy system in top shape requires regular maintenance. Dust and debris can accumulate on solar panels, reducing efficiency. Make it a habit to clean them periodically, especially after a storm or heavy pollen season. Monitoring your system’s performance is also crucial. Many systems come with apps that track energy production. Use these tools to spot any decline in efficiency early. This proactive approach can save you money and ensure your system runs smoothly. Do you have any other tips for maintaining a clean energy system? Share your insights and help others in the community.Future Of Residential Clean Energy

The future of residential clean energy is bright with the Residential Clean Energy Credit. This credit encourages homeowners to adopt solar panels and other sustainable technologies. Reducing carbon footprints becomes more accessible and affordable, promoting a greener planet for everyone.

The future of residential clean energy is brighter than ever. As homeowners become more environmentally conscious, the demand for clean energy solutions grows. This shift presents exciting opportunities for technological advancements and financial incentives.Technological Innovations

New technologies are reshaping how we harness clean energy at home. Solar panels are becoming more efficient and affordable. Wind turbines and geothermal systems are now viable options for residential use. Battery storage systems are another game-changer. They allow you to store excess energy for cloudy days or power outages. Imagine the peace of mind knowing your home remains powered regardless of external conditions. Smart home integration is also on the rise. You can now control energy usage via apps, optimizing consumption and saving money. Have you considered how much energy you could save with just a few taps on your smartphone?Expanding Credit Opportunities

The Residential Clean Energy Credit is evolving. It’s not just about solar panels anymore. You can now earn credits for installing energy-efficient windows and doors. These credits significantly reduce upfront costs. This makes it easier for you to invest in clean energy solutions. Have you explored the potential savings on your next energy-efficient home upgrade? The government aims to expand these credits further. This could include incentives for energy audits or smart home devices. What upgrades would you consider if these credits became available? Financial incentives are a powerful motivator. They make clean energy accessible to more homeowners. Are you ready to take advantage of these expanding opportunities?Frequently Asked Questions

Who Qualifies For Residential Clean Energy Credit?

Homeowners who install eligible clean energy systems qualify for residential clean energy credit. Systems include solar panels, wind turbines, geothermal heat pumps, and fuel cells. Equipment must meet specific efficiency standards. Taxpayers should consult IRS guidelines to ensure eligibility. Always retain receipts and documentation for verification.

How To Claim $600 Energy Credit?

To claim the $600 energy credit, visit the official government website. Complete the application form with necessary details. Submit required documents, like proof of income and energy bills. Follow guidelines and deadlines specified on the website. Ensure all information is accurate for a successful claim.

What Is The 30% Clean Energy Credit?

The 30% clean energy credit is a federal tax incentive. It allows homeowners to claim 30% of the cost of installing renewable energy systems, like solar panels, on their federal taxes. This credit helps reduce the overall expense of adopting clean energy solutions.

What Is The Difference Between Residential Clean Energy Credit And Energy Efficient Home Improvement Credit?

The residential clean energy credit supports solar, wind, geothermal installations. The energy efficient home improvement credit covers upgrades like windows, doors, and insulation. Both credits aim to reduce energy consumption, but focus on different aspects of energy efficiency.

Conclusion

Exploring residential clean energy credits can benefit your home and wallet. These credits support a shift to green energy, helping the environment. They also reduce energy bills, offering long-term savings. Learning about available credits is crucial for making informed choices.

By adopting clean energy solutions, you contribute to a sustainable future. Consider solar panels or wind turbines for your home. These options not only help the planet but also lower costs. Embrace clean energy and enjoy a brighter, eco-friendly tomorrow.

Investing in clean energy is a smart move for a sustainable lifestyle.